Max Bupa one of India’s leading standalon health insurance players – today introduced a digitally enabled ‘Everyday Use’ Health Insurance Plan – Max Bupa GoActive Health Insurance Plan in a event held in New Delhi. This new-age product is a disruptive and customer centric offering from Max Bupa, that caters to the ‘daily health needs’ of Indians and has been designed with an intent to bring a paradigm shift in the health insurance industry.

GoActive is a holistic health insurance plan that has been designed to give customers 360 degree coverage for their daily health needs including inpatient hospitalization and on-the-go access to OPD, diagnostics, personalized health coaching, 2nd medical opinion, behavioral counseling and much more. Max Bupa has brought together the industry’s premier health-tech providers including GOQii, Practo and 1mg, on a single platform to create a digitally enabled wellness ecosystem that will seamlessly offer all these services to its customers.

Highlighting the key benefits of GoActive Health Insurance Plan, Ashish Mehrotra, MD & CEO, Max Bupa said, “With 1 in 5 Indians being plagued by lifestyle diseases, health insurance is not an option anymore. Over 60% of healthcare expenses in the country are still out of pocket and self-funded by customers. Our aim with the GoActive Health Insurance Plan is to bridge this gap and bring more and more people into the ambit of health insurance.”

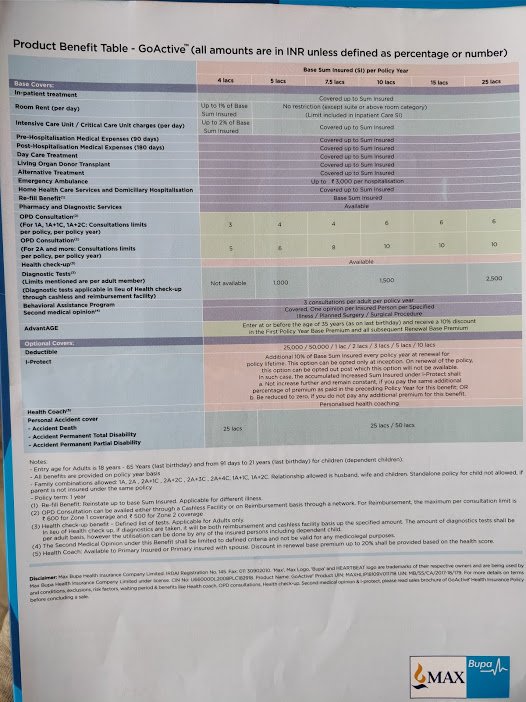

Max Bupa GoActive Health Insurance Plan offers savings to customers from day 1 including a complimentary complete body check-up up to INR 2500 per adult, diagnostics and cashless/reimbursement OPD coverage. The plan also offers benefits such as renewal discount of up to 20% on achieving their health goals. Additionally, it introduces AdvantAGE – a 10% discount on base premium at the time of buying and on all future renewals if the age of the eldest enrolled person is below 35 years.

Sania Mirza, the first Max Bupa GoActive customer in India said, “We have all heard multiple instances of lifestyle diseases plaguing not just the old, but also the young and fit. So being financially fit by investing in the right health insurance plan is as important as being physically fit for every Indian. I think Max Bupa GoActive is THE health insurance product that India needs today as it is aimed to keep people healthy and out of the hospital, while still being there in case of contingencies.”

“We are very excited with the opportunity of combining digital health and insurance on the same platform and creating a consumer centric offering. The GOQii partnership with Max Bupa is unique as it guides, empowers and motivates consumers to adopt a healthy lifestyle with the help of a Health Coach. This healthy behavior leads to benefits in their insurance plan which is a game changer,” says Vishal Gondal, Founder and CEO, GOQii

Other benefits that make GoActive an Everyday health insurance plan:

- Care @ Home – GoActive covers medical expenses incurred for home health care services through an empaneled service provider on cashless basis for an illness or injury. This includes services such as nursing care, investigations, medication (including oral and intravenous), chemotherapy, dialysis, transfusions, physiotherapy and postsurgical care.

- Behavioral assistance program – The product includes three counseling sessions per adult per policy year through telephonic mode for – pre-marital counseling, nutrition, stress, child and parenting.

- Second medical opinion – GoActive offers free 2nd medical opinion in case a customer is diagnosed with a specified critical illness or is planning to undergo a planned surgery.

Max Bupa’s GoActive plan is available in Individual and Family Floater (covers a family of 6 with 2 adults and up to 4 children) options, with the base sum insured ranging from Rs.4 lakh to Rs.25 lakh. Adults are covered from 18 years to 65 years and children as young as 91 days old are also covered. The company has bolstered its distribution spread for ensuring access to maximum Indians and will focus on both traditional as well as online channels. In the first year itself, Max Bupa anticipates GoActive will contribute to 30% of its new retail business. The product comes with Max Bupa’s 30 minute cashless claims promise.

Max Bupa GoActive – Key Features

- Cashless OPD Coverage

- GoActive doesn’t require customers to self-finance for OPD or block their hard-earned money. It comes with OPD coverage built into the base premium.

- GoActive customers will get up to 10 cashless/reimbursable OPD consultations with 10,000 doctors through Practo’s comprehensive doctor network.

- These could be consultations with general physicians, specialists, dentists, orthopaedics, paediatricians or with any other medical consultant as per the need of the customer.

- Personalized Health Coaching

- To drive the shift from “illness to wellness”, Max Bupa has introduced a new application Health Coach in association with GOQii, to offer personalized health coaching services to GoActive customers.

- The Health Coach feature will be available through an exclusive app that will document daily steps taken, food logs, etc. basis which a health score will be calculated.

- Based on the health score, individuals will be eligible for a premium discount of up to 20% at the time of renewal.

- AdvantAGE – Lifelong 10% Discount on Premium

- GoActive is the first ever health insurance product that incentivizes early enrolment with a revolutionary new industry-first feature – AdvantAGE.

- GoActive customers will get a discount of 10% on the first policy year base premium and all subsequent renewal base premiums, subject to age of the eldest insured person at the time of inception of the first policy being less than or equal to 35 years.

- Inflation Protection with ‘i-protect’

- With the rising medical inflation, a sum assured that is sufficient today, may not be sufficient10 years from now. To combat the challenge, Max Bupa is offering I-Protect as an optional benefit to GoActive customers, which gives a guaranteed 10% increase in sum insured at the time of annual renewal (without any maximum cap) irrespective of claims made in the policy year.

- I-Protect is a disruption that defies the sum assured increase cap due to the benefits it can offer to consumers in the long run, when compared to a regular health insurance plan.

- Diagnostics and Health Checks

- GoActive customers get a complimentary full body check-up worth upto INR 2500 per adult from day 1 of the policy term. The customers also have the flexibility of choosing diagnostic tests of their choice depending on their need.

- The tie-up with 1mg also offers GoActive customers ease of ordering medicines or booking diagnostic tests using the 1mg network through the GoActive app.

Customers can avail all these services on Max Bupa digital platforms. A consumer app will also be available shortly, in the next 4-6 weeks.